Health savings accounts (HSAs) are tax-advantaged accounts that you can use to save money to pay for medical care. HSAs are also excellent retirement savings vehicles since the money you contribute grows tax-free and can be withdrawn for any purpose after age 65.

Strict rules govern who is eligible to use an HSA, how much money you can contribute, and what you can use withdrawals for prior to age 65. Here are the key HSA rules you need to know.

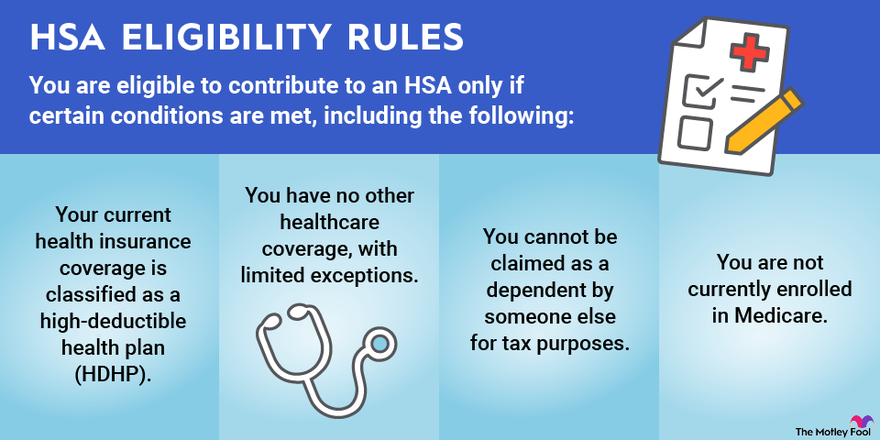

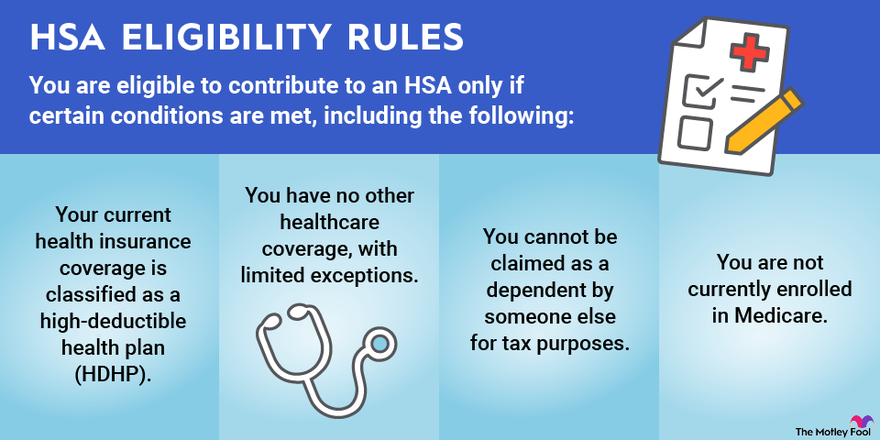

You are eligible to contribute to an HSA only if certain conditions are met, including the following:

You can contribute to an HSA and invest the funds, which enables the money in the HSA to grow tax-free for as long as you like. The IRS sets annual limits, which change periodically, on the amount you can contribute to an HSA. Here are the maximum amounts you can contribute to an HSA in 2024:

If your employer contributes to your HSA on your behalf, that counts toward your annual limit. HSA contributions generally vest immediately, meaning that any contribution from your employer is yours to keep, even if you leave your job shortly after your employer contributes the money.

Your contributions to your HSA are made with pre-tax dollars, which allows you to annually claim a tax deduction equivalent to the amount of your contribution for the year. Contributions from your employer are not considered as part of your income and are not taxed. However, employer contributions are listed on your W-2 form in Box 12 and confer a tax benefit to your employer.

Employers offering HSA plans are subject to anti-discrimination rules to prohibit them from offering HSAs that unfairly benefit highly compensated employees. Employers are not necessarily prohibited from contributing more money to the HSAs of certain employees, but they may not offer HSAs exclusively to high earners.

If you withdraw money from an HSA for any reason other than to cover eligible medical expenses, you will be subject to a 20% penalty on the amount withdrawn unless you are age 65 or older. This 20% penalty is double the 10% penalty that applies to early 401(k) or individual retirement account (IRA) withdrawals. Money withdrawn from an HSA not used for qualifying medical or dental expenses is taxed as ordinary income, regardless of whether you incur the penalty.

Unlike with flexible spending accounts, you do not have to spend money in an HSA in the same year you make the contribution. You also are not subject to the rules for required minimum distributions (RMDs) that apply to other types of pre-tax retirement savings accounts such as 401(k)s and traditional IRAs.

The IRS defines qualifying medical expenses as "the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body."

The IRS doesn't consider a medical expense to be "qualifying" just because it may generally benefit your health. For example, the IRS specifically states that vacation costs are non-qualifying expenses, even if getting away may be beneficial to your mental or physical health. Qualifying expenses must be "primarily to alleviate or prevent a physical or mental disability or illness."

The IRS provides a long list of qualifying expenses in Publication 502 to help you determine if you can use your HSA funds to pay for a particular product or service. You can use your HSA funds to pay qualifying expenses for both yourself and eligible dependents.

You can generally use HSA funds to pay for medical services offered by practitioners, along with diagnostic devices, supplies, and equipment care providers need to offer their services. Some of the most common HSA-eligible expenses are:

These are some of the expenses the IRS specifically designates as not HSA-eligible:

Several online stores sell only HSA-eligible products. Searching these stores' databases can help you determine if a particular medical product is covered by your HSA. You are not required to buy HSA-eligible items from any particular provider.

You can either spend money on qualifying HSA expenses and be reimbursed or use an HSA debit card to pay for qualifying costs.

Using a debit card can be easier, but not all HSA accounts offer this option, and not all eligible medical services are payable via debit card. If you pay for the qualifying expenses and want to be reimbursed, you must submit receipts before you can receive the reimbursement.

Once you reach age 65, you can withdraw money from your HSA for any purpose without incurring a penalty. If you are age 65 or older and withdraw money from your HSA for any reason other than to pay for a qualifying medical or dental service, you are taxed on the distribution at your ordinary income tax rate. In other words, the distribution is treated the same as a withdrawal from a traditional IRA or 401(k).

This primer on different plans can help you find the right healthcare coverage for you.

Health savings accounts can help you pay for your medical expenses with pre-tax money.

Making the most of health savings accounts means knowing the contribution limits.

Contributing to a health savings account can confer many benefits.

While there is plenty to understand about how health savings accounts work, opening an HSA is relatively simple. Most HSAs are employer-sponsored, although you can also open an HSA with one of many financial institutions.

Many employers offering qualifying high-deductible health plans also offer HSAs. To enroll, you simply need to complete the necessary paperwork and arrange to have your HSA contributions deducted from your paycheck. You will also need to invest the funds in your HSA by choosing how to allocate the money, just like you would with any retirement savings account.

While you are allowed to maintain multiple HSAs if you choose, the annual contribution limits set by the IRS apply to all of your accounts combined.